WINTER 2022 / HOUSTON YOUR GUIDE TO “BIG” BUSINESS ACHIEVEMENT RHONDA AND CHARLIE WILLIFORD Rhonda Williford Home Solutions and Williford & Company How SMBs Can Promote Digital Wellness Through Collaborative, Accessible, and Secure Technology 5 Ways Employers Can Improve Employee 10 Do's and Don’ts of Starting Financial Literacy a Destination Business

EVP/Executive Publisher Steve Levine Z”L (Of Blessed Memory)

Publisher’s Assistant Jerome Davis

Graphic Design CODEYEA Creative Design Agency

Photographer Gwen Turner Photography

Website Content Management

Zahra Rangwala/K Bizz Solutions

Contributing Writers

Mary J. West Barbara R. Davis

Columnists

Christopher Budd John Collard

Ivona Ercegovic Ed Giaquinto Danielle Hinz

Jillian Kerwin Emily Ketchen

Erin Martin-Serrano Hank Moore Greg Plunkett

Gail Stolzenburg Richard Tatum Eric Yu

Chief Advisor Hank Moore

Publisher’s Advisory Board

Denise Adjei Sonia Clayton Donna Cole John Cruise

April Day

Dr. John Demartini

Maya Durnovo

Kathie Edwards

Mila Golovine

Dory Gordon Richard Huebner

Darryl King Wea Lee

Bertrand McHenry Hank Moore

Lisa M. Morton

Leisa Holland Nelson

Cecelia Nowlin Maria Rios

Ingrid Robinson

Rita Santamaria William Sherrill

Gail Stolzenburg

Mayor Sylvester Turner

Jack Warkenthien

Phone: 832-419-1918

E-Mail: SBTMAGAZINEINFO@GMAIL.COM

Or Write: Small Business Today P.O. Box 31186 Houston, TX 77231 See us on the web at SBTMagazine.net

TOUGH TIMES NEVER LAST, BUT TOUGH PEOPLE DO!

“Tough Times Never Last, But Tough People Do” is the title of one of my favorite books written by Dr. Robert H. Schuller that is also part of my own personal library. Since I first met Dr. Schuller many years ago, I have read this book many, many times and it has always inspired me.

There is no question that small business has been hit extremely hard during the past two years of the Pandemic. The financial ramifications of the virus have caused many small business owners to make major cutbacks and/or close up for good. This is true regardless of the product, service, or clientele that they serve. Despite these adverse times, there are some businesses that still seem to flourish and even grow. These are the businesses whose owners believe that they need to play with the cards they are dealt and know that these trying times will not last. They know that yesterday is the past, tomorrow is the future, and today is a gift. That's why it's called the present!

I believe why and how they continue to grow their businesses when others are closing theirs lies in their ATTITUDE, DESIRE, & PURPOSE.

ATTITUDE

These successful entrepreneurs have the attitude that life and business is about possibilities and if their business is to succeed when others are failing, it is up to them to make the necessary changes to adapt to the challenges and overcome them. My wife and I always say, “If it is going to be, it is up to me!” There are always going to be setbacks in life and in business. The only way you are going to bounce back is to be innovative, resourceful, and do everything you can to figure it out.

DESIRE

Depending on how hungry someone is, it is in direct proportion to what they achieve and when they achieve it. No one says that success

in a challenging time is easy, but the successful entrepreneur knows that they must never, ever give up. The only way to fail is to quit!

PURPOSE

The reason why 95% of those business owners give up on their dreams is that they have forgotten “WHY” they wanted their dream in the first place. The successful entrepreneur knows that they must have strong, compelling reasons for their goals and dreams. They know they must have a strong “WHY” to become a success despite the odds against them.

Many of our 150+ cover honorees from Small Business Today, Real Estate Executive, Premier Agent, and Profiles Magazines have been Realtors®. Many of our followers on our website and social media are Realtors®, too. Realtors® are some of the most resourceful and tenacious entrepreneurs that I have ever met.

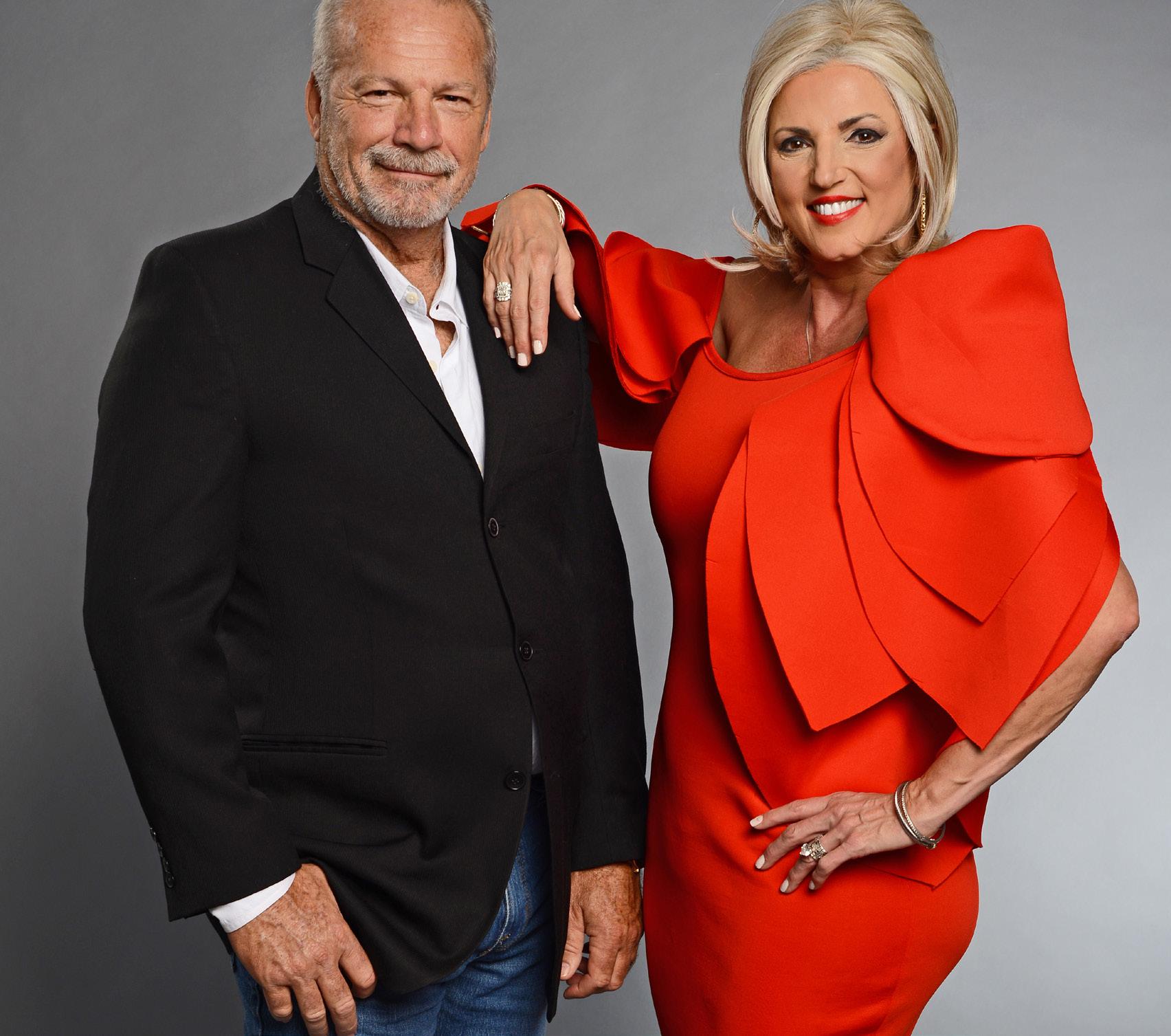

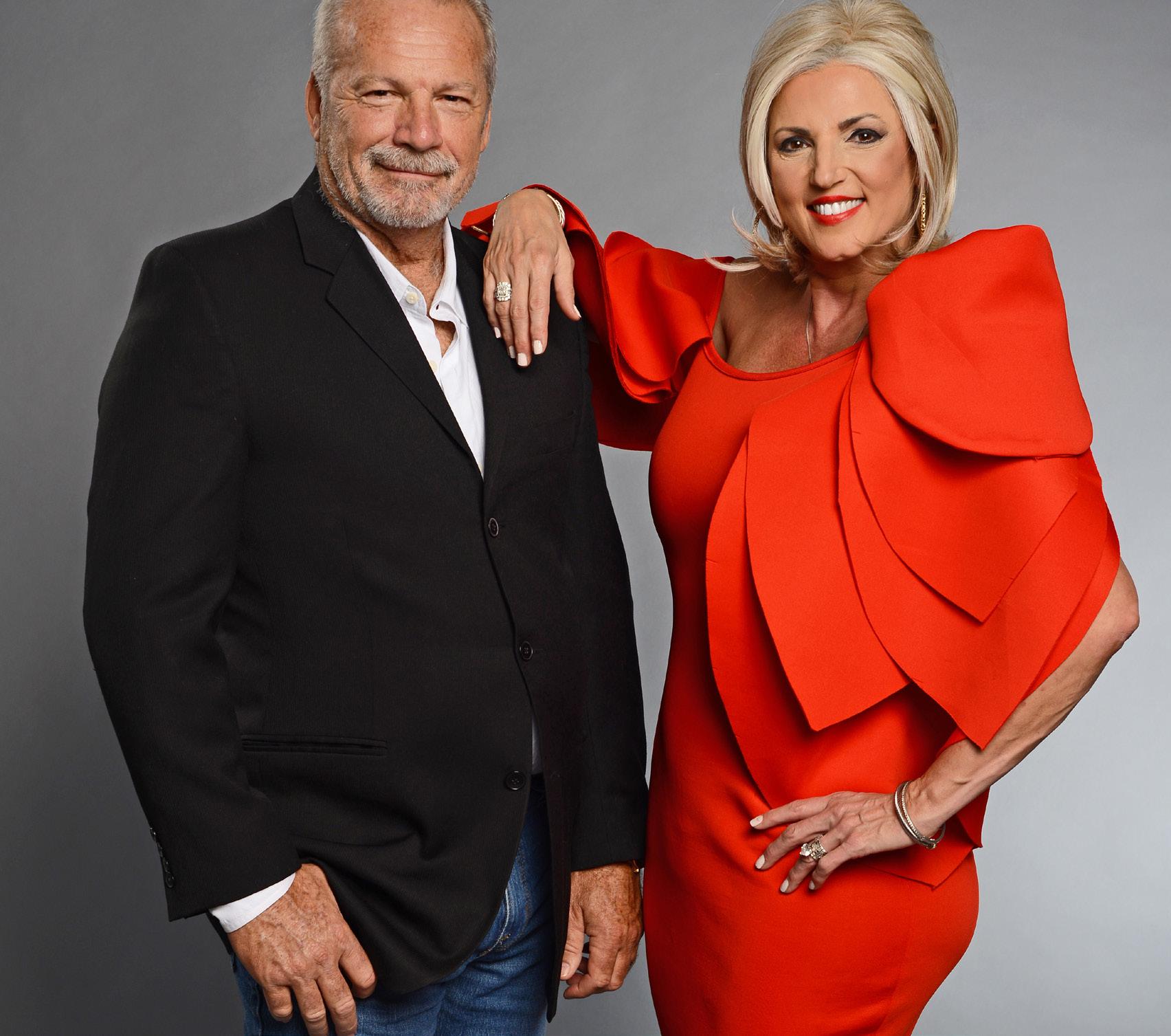

It has been my pleasure to follow one of those successful entrepreneurs since she was first honored on our Premier Agent Magazine cover in March of 2011 - Rhonda Williford of RE/MAX Compass and Rhonda Williford Home Solutions. Rhonda and her husband, Charlie Williford, who was featured in our Profiles Magazine in March of 2011 as well, have exemplified all three of those attributes, Attitude, Desire, and Purpose, in growing their companies regardless of the drastic changes in our economy and our country. I know you will enjoy reading how Rhonda and Charlie have been innovative and complementary working independently and together in their individual businesses.

Small Business Today Magazine

President/Publisher/Editor/Creative Director Barbara Davis-Levine

2022 EDITION

HOUSTON EXECUTIVE PUBLISHER’S COLUMN

WINTER

/

SMALL BUSINESS TODAY MAGAZINE

Good Reading, Good Sales, & Success to YouSteve Levine Executive Publisher

Steve prophetically wrote in his final Executive Publisher’s Column that “Tough Times Never Last But Tough People Do”. Who knew that I would be one of those people he was writing about?! Since Steve died of a heart attack in his sleep in August of last year, it has been a struggle for me to get SBT Magazine back on track. It has been a great learning curve in replicating everything Steve did without him leaving me instructions. A special note to those of you who work with your spouse or business partner: Make sure you have your systems and procedures written down about what each of you does and then make sure to give each other a copy!!! To add insult to injury, our website was repeatedly attacked and eventually breached but our IT Team eventually won the battle. Please be patient as I work with them in updating everything on the website pages. If you notice a screw up, just let me know and I will do my best to fix it. Starting with this Winter 2022 Edition, Small Business Today will be published quarterly. If you are interested in being a columnist, an advertiser, or participating in some other capacity, please feel free to email me at SBTMagazineInfo@gmail.com.

I wish to give special thanks to this edition’s Cover Honorees - Rhonda and Charlie Williford, Profiles – Bitcoin of America/ Sonny Meraban, Lenovo/Emily Ketchen, Unc B’s Seasonings/Bryanal Davis, and RELEVE Brand (formerly Be Pure Naturals)/

Wendy Williams for their patience and understanding during this most difficult time in my life and business. More thanks go out to our new, talented Graphic Design Agency, CODEYEA Creative Design Agency, who has been a blessing for helping me rebuild the magazine from scratch, Amira Mannai, publisher of The Princess Magazine, who graciously referred CODEYEA to me, our brilliant, go-to writer who gets me - Mary J. West, our award-winning and very patient photographer, Gwen Juarez, and our terrific, dedicated IT Team - K Business Solutions/ Zahra & Amir Rangwala for going above and beyond the call of duty in saving our website from evil hackers! I can’t leave out thanking James McInvale, Jr. for allowing us to stage some photos for our Cover Story in the lovely showrooms at Gallery Furniture Galleria. Last but not least, I’m sending hugs, kisses, and lots of thanks for all the support I received from my great friends (too innumerable to mention) and my family - Gina & Brad Dennen, Jerome Davis, Tracey Levine, and “adopted” family - John & Shon Cruise.

Steve and I were married for 22 years, and most of that time we worked together in our various publications. We complemented each other in our strengths and each of us did our share of what we excelled in the best. Steve was the detail guy. He was extraordinarily regimented in keeping everything on track and handling the communications between

the clients, the contributing writers, the photographer, the graphic designer, and the IT staff. He handled the sales contracts, the billing and collections, and scheduled the appointments. I edited every written article going into the magazine, interviewed the Cover Honorees and Profile Subjects, worked with our writer, Mary J. West, on the title for the articles and the intro paragraphs, and did the creative staging wi th our photographer, Gwen Juarez, on all the wonderful photos used for the Cover Honorees and Profiles.

I am as tough as they come; I may be down but I will never be out! I have been widowed twice. I was married 22 years to my first husband, Steven Davis, when a drunk driver killed him and I was so critically injured that I was declared brain dead! At that time, we owned Celebrity/24 Hour Travel and were extremely successful. I reinvented myself before, and I am doing it once again; so, you might say this is my “Second Act”. Any help you care to offer, especially suggesting advertisers and potential Cover Honorees, will be gratefully appreciated! I give commissions to anyone who refers business to me once the transaction has been completed.

In addition to our in-it-for-the-long-haul, entrepreneurs extraordinaire Cover Honorees, Rhonda and Charlie Williford, who are great partners in life and business (much like my husband Steve and I were), this issue features Profiles on several companies that

WINTER 2022 EDITION / HOUSTON PUBLISHER’S COLUMN

SECOND ACT

TOUGH TIMES NEVER LAST, BUT TOUGH PEOPLE DO!

were started by entrepreneurs with that “can do”, never quit spirit. Bitcoin of America, a company started by Sonny Meraban, is taking the US by storm and is growing like gangbusters with their BTMs (like ATMs but for Bitcoin)!

Lenovo has quickly risen to become the largest PC company in the world and one of the largest IT companies. Their focus and solutions are helping businesses stay afloat in these trying times. Emily Ketchen is one of the contributing writers and is a brilliant, dynamic leader at Lenovo.

On a smaller scale but gaining a lot of traction are two great, Houston-based

companies: Unc B’s Seasonings and RELEVE Brands (formerly Be Pure Naturals):

Two-term Veteran, Bryanal Davis’s allnatural Unc B’s Seasonings makes anything you cook become a culinary masterpiece!

Whenever I go out to eat, I take packets of Unc B’s General Purpose Seasoning to flavor my food because it is low in salt and free of chemicals and sugar.

Last but not least, is Houston’s own Wendy Williams, a single mom and the visionary behind RELEVE Brands (formerly Be Pure Naturals), a company that specializes in great all-natural products for aches & pains, dry skin, insect repellant, and hair growth.

My favorite product of hers is the Healing Balm. I use a little bit on my hands and they stay smooth and soft all week.

After you have read all of the inspiring stories of our Cover Honorees and Profiles featured in this issue, I hope you will show your support by using their products, services, referring them to others, and even dropping them a line that you read about them in Small Business Today Magazine.

Good Reading, Good Sales, & Success to YouBarbara Davis-Levine Publisher

SMALL

BUSINESS TODAY MAGAZINE

Sonny Meraban — Bitcoin of America

Right Timing Can Make a Critical Difference in the Road to Success

BY MARY J. WEST

The road to success is seldom a straight line with entrepreneurs achieving prosperity on their first venture. Instead, it often involves detours and wrong turns as they learn what works and what doesn’t. Missteps are actually stepping stones to profitability because they teach valuable principles needed to establish a strong enterprise. Such is the case with Sonny Meraban, CEO of Bitcoin of America (BOA), who changed businesses several times before entering the cryptocurrency industry. The wrong timing appeared to underlie his missteps, while the right timing seems to undergird his current soaring profits. “Timing is everything,” he says.

Referring to himself as a serial entrepreneur, Meraban’s twisted path to success involved two disappointments previous to finding his niche in bitcoin. The entrepreneur first ventured into the automobile industry and became the owner of three dealerships while he was in his twenties. When the economic crash of 2008 put a damper on car sales, he decided to switch gears. It obviously wasn’t the ideal time for this type of business.

Next, he delved into real estate, but the housing crash hindered this venture from gaining a solid footing. Once again, the timing wasn’t right. “Basically, the real estate business was my second career change,” Meraban says. “I hear that a working male goes through three career changes, and it probably took me a couple of years to figure out bitcoin in 2015.” So after getting out of real estate, Meraban’s business dabbling during the next two years led him to the bitcoin industry and the creation of Bitcoin of America. The idea started when he had an interest in becoming a a drop-ship merchant who could provide an automated method of payment for customers wanting to buy his product. Yet again, this venture hit a roadblock when he encountered difficulty in finding a merchant processor.

One day, while buying bitcoin from a website to play online poker, he had an epiphany. “What if I could process bitcoin in

a similar way?” Meraban began researching the bitcoin industry and eventually developed an interest in owning a bitcoin ATM known as a BTM. His inspiration got a boost one day in 2014 when he came across the first BTM in his hometown of Chicago. It was near his home and the owner happened to be there, so Meraban started talking to him. Through this relationship, Sonny acquired his first BTM in 2015, which was the catalyst for starting Bitcoin of America and launching his third career.

So exactly how does a BTM work? “Basically, you punch in your name and contact information to get verified,” Meraban explains. “Then, you put money into the machine to purchase bitcoin, which will appear in your digital wallet. Afterward, you may use the cryptocurrency to make purchases from companies that accept it as a payment option, such as Microsoft, Starbucks, and Overstock.”

Meraban’s decision to enter the bitcoin industry was partly based on timing. The bitcoin industry was young at this point but he felt it might play a more prominent currency role in the future. The time seemed right to take the plunge, and in this case, Sonny's third foray into entrepreneurship with Bitcoin of America turned out to be a charm. Even so, success wasn’t immediate. Meraban spent the first year with just one BTM while he learned the software and placed the machine in a store. However, his persistence and patience paid off handsomely, and after ironing out the initial difficulties, his business took off.

The rest, as they say, is history. The seven short years following BOA’s launch have shown impressive growth. Although the company started modestly with one BTM, it now has over 1,400 BTMs throughout the United States. This number makes up 5% of the U.S. BTM market. In addition, the initial location was in Chicago, but it is now in 31 states with more on the horizon. The company’s growth in the past year has been particularly phenomenal. Their top-line revenue increased 220%, and their

earnings rose eight times the amount of last year. Such expansion has led to growth in the company’s team. The number of employees spiked 32% in one year. BOA’s robust growth garnered the attention of Inc. Magazine, which named it one of the fastest growing companies in the U.S. In fact, the magazine has included BOA in its Inc. 5000 list. Meraban is excited about the honor and the exploding expansion of his company that it represents.

Bitcoin of America is not limited to BTMs. Its services include tablets and online exchange as well. “Tablets are like an ATM in the palm of your hand,” says Meraban. BTM recently took another step forward in May of 2021 when it introduced what Sonny calls a “Universal Kiosk”. This offers services beyond those of a BTM, as it allows people to purchase cryptocurrency in different ways. Meraban’s journey to success shows that timing may just be the secret ingredient that makes a critical difference in entrepreneurship. Certainly, it plays a key role when an aspiring magnate builds a flourishing company.

Even if an individual possesses considerable business acumen, when the business climate isn’t right for a particular undertaking, it poses a hurdle that is almost impossible to overcome.

Conversely, when the timing is right to launch an enterprise, it can serve as the fuel that propels profits into the stratosphere. Meraban's great success in the launch and growth of Bitcoin of America illustrates this principle.

To find out more about Bitcoin of America, one can visit BitcoinOfAmerica.org or BitcoinOfAmerica.com.

PROFILE

client, and serve as advisors to the businesses that are their customers. Just what is this “listening”thathaspropelledthecompany toitsleadershiprole?Ittakesseveralforms, allofwhichallowittounderstand,support, and provide remedies for its customers. One form is a robust insight community whereLenovoengageswithmorethan4,500

customers who own small and medium businesses. The community continually asks customers how things are going from a technological perspective. In addition, Lenovo has advisory councils, which are constantly hearing from customers and helping them solve their challenges. Other listening comes in the form of research that involves focus

INSIDE WINTER 2022 / HOUSTON YOUR GUIDE TO “BIG” BUSINESS ACHIEVEMENT RHONDA AND CHARLIE WILLIFORD Rhonda Williford Home Solutions / Williford & Company There is a typo at bottom of cover on right. You put 10 Do's and Don’ts of Starting Starting a Destination 5 Ways Employers Can Improve Employee 10 Do's and Don’ts of Starting Financial Literacy a Destination Business T he current health and future wellness of business can stem from myriad of factors. Now more than ever, businessesaredealingwithchallenges they have never before encountered. For them to survive and flourish, they need to consult with specialists who can empathize with their problems, really listen, and provide successful remedies. One company in particular, Lenovo, has madesuchacriticaldifferenceintakingthe pulseofsmalltomediumbusinesses(SMBs) and providing successful remedies that it has quickly risen to become the world’s largest PC company and one of the largest IT companies. Lenovo offer all kinds of technology solutions, from smartphones and personal computers to services and complex data but what sets them apart is that they are focused on listening to their clients and providing them the devices, solutions, and services that help, serve, and solve their technology needs. According to Emily Ketchen, Vice President and Chief Marketing Officer of the PC and Smart Devices Division. “Being great listeners involves several methods of collecting feedback from customers which has given usinsightsinhowtobestmeettheirneeds.” These insights have enabled Lenovo

televisions, they took the opportunity to push technology forward. Later, in 2005, they acquired the personal computer divisionofIBM,andthatiswhere number of the PC pieces came together such as In addition, Lenovo developed consumerbased and gaming products such as Yoga and Legion. No wonder that Lenovo has become the largest, worldwide vendor of personal computers! Lenovo, whose mission statement is “To provide smarter technology for all”, can trulyrelatetobusinessownersbecausethey toohaveanincrediblyentrepreneurialspirit whichdrivesbothindividualcontributions and meaningful results. Notes Ketchen, “Lenovohas uniqueentrepreneurialspirit thathasledtotheproductionofanenviable breadth of technology portfolio. It sells products in 180 countries, which includes desktop, laptop, and tablet computers, as well as smartphones, storage devices, and peripherals. The company also carries servers,supercomputers,andcomplexdata systems solutions.” Despitesuchabroadarrayofelectronics, Lenovo’s primary goal is not to sell but to listen intently, take the pulse of the

to devise innovations that have made it visionary leader in electronics on the world stage. Launched in China in 1984 by a group of technologists who got their start as a small business specializing in

groups and observationalstudies.Thecompanyalsohas a customer insights dashboard, listening toolthathascapturedmorethan20million unsolicited comments from those who buy their products. Lenovo has harnessed informationgainedthroughthesemeansof customer engagement to improve product features. Such innovations deliver tangible advantages, often addressing the needs of customers before they’re fully aware of Because the business climate is everchanging, it’s essential to keep a close pulse on it to keep up with the times. “One example involves this world of 24/7 collaborationwheresomeofusareworking from home,” Ketchen relates. “We thought, ‘Wouldn’t it be great to have a laptop that includes built-in earbuds that are charged, automaticallyconfigured,andoptimizedto make easy to hop on call or participate in meeting?’ So we included that in our ThinkBook 15-inch laptop, a brand we specifically created for SMBs. It’s a great listening to customers.” PROFILE Lenovo Listening to SMBs, Taking their Pulse, then Providing Successful Remedies for Business Health and Future Wellness By Mary J. West continuedonpage35 18 SBTMAGAZINE.NET Winter 2022 06 COVER STORY 18 LENOVO PROFILE FEATURES ADVERTISERS 01 Executive Publisher’s Column 03 Inside Front Cover Gwen Juarez Photography LiftFund 02 Publisher’s Column 04 Sonny Meraban - Bitcoin of America 13 Changing Your Mindset for Networking Success 15 What Small Business Owners Need to Know When Hiring and Firing Employees 16 5 Ways Employers Can Improve Employee Financial Literacy 17 How to Get the Most Value out of a Business Credit Report 14 Protecting Your Company from Business Email Compromise (BEC) Attacks 11 Make the Right Data-Driven Decisions for Your Business Without the Need of Big Data 19 How SMBs Can Promote Digital Wellness Through Collaborative, Accessible, and Secure Technology 12 Business Regeneration – Lessons Learned from COVID 20 The Role of Subcontracting in Supplier Diversity 21 How To Protect Your SMB Website 24 10 Do’s And Don’ts Of Starting A Destination Business 25 Why Hire Outside Directors When Private Companies Don’t Have To? They Bring Change! 26 The Obituary of Steven Paul Levine Z”L (of Blessed Memory) 30 Wendy Williams - RELEVE Brands (formerly Be Pure Naturals) 31 How Small Businesses Can Sustain Success During “The Great Resignation” 32 Bryanal Davis – Unc B’s Seasonings 33 8 Tips for Selecting the Best Bank for a Small Business 34 Looking to Raise Funds? Here’s What Every Small Business Entrepreneur Should Know 22 36 CODEYEA Creative Design Agency River Oaks Chrysler, Jeep, Dodge, & Ram 23 Autism Speaks - Ad Council Back Cover Phil & Derek’s Restaurant & Jazz Bar 36 Optima Vitamins Inside Back Cover PAWS, HOOFS, & CLAWS WINTER 2022 EDITION / HOUSTON

Rhonda and Charlie WillifordGreat Partners In Life and In Business - Helping Real Estate Clients and Making Them Feel Like Family

By Mary J. West

The intensely caring nature of both Rhonda and Charlie Williford were the driving force behind the launch of their flourishing businesses and, indeed, their continuing success. Early on, Rhonda wanted to have the kind of company that would treat clients like family. Charlie shared the same passion. Consequently, when they met on one fateful evening in 2007, they quickly realized they were soulmates, which led to a beautiful marriage. This great life partnership eventually evolved into an informal business partnership that has brought them great fulfillment and helped a multitude of people.

While the couple’s businesses are technically separate, they frequently intersect. In her work as a Realtor® and design specialist, Rhonda routinely encounters sellers who need the services of a contractor to help remodel their homes in preparation for being listed. Likewise, in his work as a contractor and insurance adjuster, Charlie meets clients who are interested in selling their homes and need a great Realtor® and/or design specialist. Working side-by side in assisting clients achieve their real estate goals and dreams, Rhonda and Charlie not only help their clients together, they are able to provide each other’s expertise as well.

Undoubtedly, if Rhonda and Charlie had never met, they would still be the owners of successful businesses. However, they embrace working together and helping their clients. They also have an ever-expanding group of people whom they have welcomed into their business family. For over 17 years, Rhonda Williford has been a “mover and shaker” in the real estate community and is the sole proprietor of Rhonda Williford Home Solutions, a RE/MAX affiliation. In addition to being the Team Leader, Rhonda has two Buyer's Agents - Lori Cassity and Chanta Brown.

Rhonda uses her talents, skills, and knowledge in helping people buy or sell their homes. When sellers contact Rhonda, she gives them a choice of two options. They can either list their homes without making improvements, or they can first invest money in home improvements which often pays off in a larger selling price and a shorter time on the market. When clients choose the latter, Rhonda acts as their design specialist and advises them in what steps are necessary to take in increasing their home’s marketability, curb appeal, and value. After following her recommendations, it is not uncommon for her clients deciding not to sell because they find the improvements too appealing to leave.

Rhonda’s advice in enhancing her clients’ home appeal depends on how much they are willing to invest. Sometimes a few changes can make a great deal of difference. These may include decluttering and cleaning the interior, along with refreshing the yard. Other simple changes may involve removing outdated carpeting, adding some fresh paint, changing light fixtures, or replacing a few appliances. In addition, Rhonda may suggest changes to facilitate better flow within a home. For example, when people are cooking in the kitchen, they want to be able to easily speak with family members or guests in the living room. They also like to be readily accessible when children are doing their homework. In other words, if the interior of a home flows well, it’s more functional for the residents and more desirable to potential buyers.

Rhonda’s clients represent many walks of life, so she has experience in selling everything from starter homes and “fixeruppers” to luxury high-end properties. Regardless of her client’s income, she values each of them. “I don't care if you have $80,000 or $8 million to spend, you're just as important,” remarked Rhonda.

Rhonda & Charlie - The "Dynamic Duo"

Photography by Gwen Juarez

Cover Story

Rhonda Williford Home Solutions/Williford & Company

She is as adept at enhancing homes with a limited budget as well as she is with those who have an extravagant budget. Even if a client has only a relatively small sum to spend on home improvements, Rhonda's creative flair and shopping savvy can transform a lackluster residence into an enchanting abode. “I’ve made modest homes look like the Taj Mahal by picking up items from places that deliver design that fits any budget, from discount to designer,” explains Rhonda.

Rhonda is quite the resourceful shopper. It is not unusual for her to find unique items at flea markets that make wonderful conversation pieces. She is always thinking outside of the box in getting her clients what they need at the best price. Rhonda elaborated, “Furniture auctioneers who sell items for people who are downsizing or moving overseas are another treasure trove for home furnishings. It’s fun to have a diverse variety of shopping sources.”

Although the sellers’ side of real estate is Rhonda’s specialty, she also enjoys working with buyers. When people who want to buy a home contact her, she takes time in determining their needs. “Because sometimes they don’t know what they need or want,” explains Rhonda. “I ask questions to narrow down areas that best suits their needs.”

Whether Rhonda is working with sellers or buyers, she feels one of the keys to her success is the way she treats people like family. “I got into this business because I thought I could make a difference by taking care of them in the most optimal way,” reflects Rhonda. “The secret to having satisfied, happy clients is treating them the way I would want to be treated. One by one, I can make a difference.”

The other half of this wonderful couple, Charlie Williford, has been in business for over 40 years as an expert contractor. He initially got the idea for his enterprise, Williford & Company, when he was just 18 years old and working as a painter for another contractor. “After two years, I said, ‘Shoot, I can do this myself.’ And that's how I got started,” recalls Charlie.

Today, Charlie employs carpenters, granite workers, plumbers, and flooring people as part of his talented team. He also subcontracts with other reputable businesses that he has established relationships with. In addition to being a contractor, Charlie is also a licensed insurance adjuster. “I know how the game is played and what the insurance company is supposed to pay the homeowners for their loss,” explains Charlie.

“They can't push the homeowner around if I'm with them. And I help the homeowners walk through the whole process, including contacting the mortgage company, getting an estimate, and whatever else is needed. This expedites the process for the client and maximizes what they get from the insurance company for their loss,” states Charlie.

Ask any business owner and they will concur that it isn't easy retaining competent, long-term employees, so it is a real a testament to the quality employer Charlie is, knowing that some of his employees have worked for him for over 35 years! What's even more amazing is that some of his employees’ children, who are now adults, have followed in their parents' footsteps and work for him, too.

It's quite evident that Charlie is a great boss. Everything he does is with integrity and pride in his workmanship and his employees reflect those qualities as well. Charlie is confident in his employees’ honesty and trusts them completely when they are working in a home where the owner has valuable possessions throughout the home. Of course, Charlie is bonded, but just the same, he knows he never needs to worry that his crew would ever act in an untrustworthy manner.

Often, the Williford’s businesses will intersect, and they’ll work as a team. When Rhonda is working with sellers who need a contractor to remodel their homes, she’ll recommend Charlie if they ask for her advice. She will tell them, “You can use who you wish, but if you need a trustworthy contractor, I have one!”

When expertise and experience matters, Rhonda is the key person to call!

Photography by Gwen Juarez

Most clients choose working with Charlie and Rhonda together as a team because they make a dynamic duo! Consequently, Charlie’s crew may do the painting, flooring, and other things needed that provide the appeal their home needs to maximize a selling price in a timely fashion.

Conversely, in his construction work, Charlie encounters people wanting to sell, so he puts them in touch with Rhonda. Even though Rhonda and Charlie recommend each other to their clients, when it seems appropriate, they never pressure their clients to hire each other. Rhonda explains, “I’ll tell them, ‘This is what you need to do, and I can get my husband’s crew that I guarantee is trustworthy because we’ve worked with them for so many years.’ I leave them alone while they make the decision, but 99% of the time, they'll say they want to use Charlie’s contracting crew.”

The business partnership the couple embraces involves more than just referring clients to each other.

Their shared principles in treating their clients like family has led them to go above and beyond the call of duty when their clients are going through difficult situations including offering their services and expertise at no charge. To illustrate, as a contractor, Charlie has done restorations for people who have home damages from a fire or flooding. These individuals need advice in many aspects of home improvement such as selecting flooring and paint colors, as well as planning a backsplash, updating a bathroom, or reconfiguring a space. Rhonda works with them for free in these areas. In addition, when Rhonda gets her home inspection reports back, Charlie helps her by writing estimates on repairs the buyers or sellers want.

The couple’s togetherness is a win-win situation, and their clients benefit most of all! This teamwork and dedication to their clients' well-being also means that Rhonda has been known to get up at midnight to paint a client’s wall, or that Charlie might run over to a seller's home to winterize the plumbing during an ice storm.

Formulas for success are usually complex and involve many factors. Aside from treating people like family, Rhonda and Charlie have other personal qualities that likely play a role in their success. For instance, rather than relying heavily on voice mail, they make themselves available to their clients and personally answer their phones throughout much of the day and evening. “It's important for me that clients are able to get in touch with me,” explains Rhonda. “And Charlie feels the same way. We understand that when someone is talking about their greatest asset, their home, they need to know you’re not ignoring them, and we see their concerns as urgent as they do.”

Just like Charlie, one of Rhonda’s standout features is her integrity. Her husband works with several Realtors®, but she will never take away a listing from one of them. In fact, if one of his clients complains to her about their Realtor®, Rhonda will call the Realtor® and convey what needs to be done to make the client happy. She encourages the client to work things out with the Realtor® if at all possible. Rhonda reflected, “I think everybody should be given a chance because you never know what somebody is going through at that moment in time. We don't try to step on anybody's toes.” Another personal quality that underlies Rhonda’s success is that people are drawn to her warmth and congenial personality. She is a “down home” girl at heart and everyone experiences it the minute they meet her. Her great charisma always makes people feel at ease. “I’ve been told by many that my energy just pulls people in,” says Rhonda with a big smile on her face!

According to Rhonda, one of Charlie’s best features that has helped make his company strong are his communication skills. “He is great at putting people at ease and assuring them a job will be done to their satisfaction. If my husband takes on a project, it's going to be done right,” states Rhonda. When Rhonda and Charlie meet with clients, they feel it’s vital to determine what their expectations are. Rhonda explains, “Everyone is different, so you can't assume that they’re going to think the same way that you do,” With this in mind, the Willlifords try to listen carefully to their clients so they can give them exactly what they want.

The personal and professional qualities that the couple bring to their work has earned them loyal customers.

Charlie hard at work making plans.

Photography by Gwen Juarez

Cover Story

“We have repeat customers from years and years ago,” says Charlie. “I've done one house three times after it flooded each time.” In addition, most of their clients come from referrals, so they rarely have the need to advertise. “We get a lot of word-of-mouth business,” adds Charlie. The togetherness that is an integral part of the Williford’s business endeavors is likely a natural outflow from their close marriage. Although they have been married for over 14 years, they still act like honeymooners. When asked how they keep their relationship fresh, Rhonda and Charlie shared, “We always sit beside each other when we are dining out. And whether it is work or play, we love holding hands and being together.”

Truly, this marriage is a rare gem. “We can be together all weekend long, but when Monday comes and I go back to work, I just miss her terribly,” reflects Charlie. “The more time we spend together, the more we like it. We always are each other's sounding board and have the utmost respect for each other,” adds Rhonda. The relationship has fulfilled Rhonda’s long-held dreams about love and marriage. She elaborates, “I always wanted to be treated like a queen and be put on a pedestal, but I wanted to have somebody to treat that way as well. It should work both ways. I finally found that special person that I thought did not exist.”

Family life is also very important to the

Willifords. They cherish each moment spent with their eight children, three of whom are Rhonda’s and five of whom are Charlie’s. The couple also dote on their five grandchildren. The Willifords are justifiably proud of their children, all of whom appear to have bright futures. The oldest, Lyndsay Richardson, a University of Houston magna cum laude graduate, is a pharmaceutical sales representative. The second to oldest, Stephanie Brown, a University of Houston graduate, runs one of the biggest restoration companies in the city. The next in line is daughter Reygan Cox. She is finishing up her degree in Hospital Administration and works as a tax accountant at Heights Financial Services. Son Jake Williford, a cum laude graduate from Texas Tech University, holds a Master’s Degree in accounting and works for Ernst & Young. Continuing down the line are twin daughters Ashtin and Story Williford. Ashtin is a Texas A&M Mays Business School graduate and employed with AT&T. Story is a University of Texas McCombs School of Business graduate and employed at Oracle. Daughter Waverlee Sykowski, a cum laude graduate from the University of Houston C.T. Bauer College of Business, is employed by Andersen Tax LLC. The youngest, Logan Sykowski, is currently in college and working towards his degree in Economics and Finance.

When asked how they juggle business with family life, Rhonda commented, “I still love homemaking tasks, gardening, and cooking, but sometimes juggling work and family means my house doesn't get as clean as I would like even though I’m a neat freak. But you know what? It all eventually gets done. We just make it happen. Recently, we became empty nesters and the pressures of balancing aren’t as demanding.”

The Willifords’ hard work and dedication to their clients has paid off handsomely. Their businesses are thriving and they enjoy the fulfillment that comes from working on projects with all their heart. They give over and above what is expected, and consequently, their clients are loyal as well. Since Rhonda and Charlie treat them as if they’re family, they have a bond with them that transcends mere business.

Although Rhonda and Charlie feel blessed by their business partnership, their life partnership is an even greater blessing. They are inordinately rich in the things that money can’t buy - namely love, respect, family, and a keen delight in each other’s company. At the end of each day, when all the work is done, they savor the quiet yet sublime joy that comes simply from being together.

When it comes to helping their clients, Charlie and Rhonda are the perfect combination.

Photography by Gwen Juarez.

When it comes to helping their clients, Charlie and Rhonda are the perfect combination.

Photography by Gwen Juarez.

Rhonda and Charlie's Words of Wisdom for Success

1. Having the funds to start your business is essential. This means you need at least a few months’ worth of payroll and all your other overhead in the bank.

2. Be reliable. Do whatever you say you’re going to do. Clients need to know they can count on you and that you are a person of your word.

3. Make good communications a priority. We are there for our clients 12 hours each day. When a client calls and we are occupied, we answer and say, 'Just give us a few minutes and we’ll call you back.' As long as you communicate when you will be available and then do what you say you will do, you will prevent them from getting frustrated.

3. Treat your employees and your clients with respect and honesty and they, in turn, will treat you the same way. That's one of the reasons we have loyal employees and clients.

4. Be teachable and never stop learning. Don’t be the kind of person who thinks they know everything. There's always going to be a new scenario or project from which you’re going to learn something new. The more you know, the better you can help your clients.

5. Don’t let money be your motivator. Instead, let your driving force be on protecting your clients' best interests and meeting their needs to the best of your ability. You must focus on making the client happy. If you do this, you’ll be the first person who your clients will think about when they need your services. This will even happen if they have 10 friends who are your competitors.

Cover Story

Photography by Gwen Juarez

Make the Right Data-Driven Decisions for Your Business Without the Need of Big Data

BY ERIN MARTIN-SERRANO

Big data has become a buzzword in the field of data analytics as more companies seek to harness the seemingly endless amounts of information that they possess to improve their profitability. While small and medium-sized businesses (SMBs) may not have big data analytics, their ability for making the right data-driven decisions remains a key factor in the company’s success.

Data-driven decisions enable people to make course corrections that leave a positive impact on the business and align with their goals. While big data is not required, the focus on which sources of data to analyze is. Outlining the right process for the size of your business will get the maximum return on investment (ROI). Here are important steps to follow which enable better data-driven decisions for SMBs.

Identify and Be Specific on Areas to Improve

Being specific will help define the focus of your efforts and avoid being sidetracked from your goals. Starting with a broad topic such as quantifying customer satisfaction might be a good starting point but that is only scratching the surface on discovering insights.

For example, a past client of mine wanted to determine how to prioritize their assets. After reviewing the book value of each asset, I realized that it did not identify which asset generates the highest customer satisfaction or revenue. Simply knowing which assets are the most popular with customers does not provide a financial number to its true value. To explore further, the client and I assigned a rating system to all aspects of the asset: financial book value, customer ranking through surveys, customer traffic, maintenance costs, and the physical condition of the asset.

Define Metrics and a Rating System

Take each identified metric and list them for consideration in the rating system. For example, here are some methods that I have used:

1. Most popular assets - customer ranking via surveys and customer traffic

2. Customer traffic - the business physically counts people who used the asset

3. Financial book value - review financial statements and assign ranking values (1-5)

4. Physical condition - another rating system of 1-5 where 5 is “like new” condition and 1 represents “major overhaul required”

The rating system for physical condition was assigned by the head of maintenance for each asset. Having competent and relevant members of the organization developing these metrics will provide more accurate assessments and a better understanding of the process.

Gather the Data

Once the rating system is set with all known assumptions captured, the next step is to gather the data. During this step, it is important to use the same capture method for each asset to maintain consistency in reporting. In other words, if you are using machine learning to count overall traffic for one asset, do not use an employee to count the other ones.

Establish a Frequency

Once enough data is captured and reviewed, then determine how often to repeat these assessments in the future. This may be each change of the season or every business quarter. There can be flexibility in picking a frequency meaning that can be adjusted as required to facilitate improvement.

During the review stage, the finalized prioritization might come as a surprise. The enjoyable part of datadriven decision-making is that you can objectively consider what to focus on that will improve the bottom line. For my past client, the asset with the highest book value was not the most popular with customers but it received a lot of focus from financial reviewers. After gathering data, a data-driven decision can be made on where to invest capital first to where it would have the biggest impact on the overall business.

Data-Driven Growth and Improvement

SMBs can benefit from creating a process that fits their size of organization and making data-driven decisions which increases profits while underscoring the true value of an asset. Access to big data is not needed here. Outlining the minimum metrics, data sources, and what you want to improve will reap valuable returns and business insights.

EDITORIAL FEATURE

Erin Martin-Serrano is the Director of Business Development with Hedgehog Technologies. Contact: www.hedgehogtech.com

Business Regeneration

–Lessons Learned from COVID

BY HANK MOORE

BY HANK MOORE

Business recovery requires a lot more than loans to tide them over. Businesses need strategies. They need to know there is a place for them in a changing landscape. In addition to the health effects, COVID negatively impacted the economy and spurred a recession. The pandemic caused dislocation in business. Stopgap measures to recover business resulted in false starts, forced openings, forced closings, and the loss of customers. Those who were shutdown reported loss of marketplace, dislocation of clientele, and spending cuts that harmed their small businesses the most. According to surveys, 50 percent of business owners believed that the crisis would pass within four months. 54 percent of businesses closed for short-term periods, and 47 percent were marked by unemployment. Declines of 50 percent were highest in the hospitality industry.

The duration of the crisis played a huge role in the impact.

In the first months, 72 percent of businesses expected to reopen. After eight months, 47 percent expected to recover and reopen. Social distancing had a direct impact on customer service, relationships, and repeat business. 48 percent of workers in small businesses have livelihood directly tied to the ecosystem caused by downturns. Many found new jobs, took stopgap jobs, or gave up on their careers altogether. Liquidity crunches with cashflow disruptions showed slower cycles in recovery. Businesses suffered closures, losses, and missed opportunities. Many workers saw career dreams dashed, lost career momentum, and a reality that putting things on hold might encounter changed business dynamics.

Customer service suffered.

When you heard terms “contact-less and contactfree,” I heard customer service sinking to new depths. Human interactions were minimalized, making restoration of customer service more difficult on the backend of the pandemic. Some businesses added COVID charges to bills, citing increased cleaning and sanitation services plus costs for PPE. Many cited the loss of business in other areas due to the pandemic including limited occupancy charges, paying workers when the business was closed, and costs associated with re-launching businesses.

Hidden fees are nothing new.

Those who pay cable bills, healthcare statements, and academic charges are beset with recovery charges. Consumers who were hit hard by the pandemic had to bear the brunt for COVID charges. The auto industry thanked consumers for past business and encouraged them to buy more cars as an economic incentive. Education was changed by COVID. Learning went virtual, as did professional development. Many associations cut vital programs and met by losses in dues and participation.

Terms we learned during the pandemic included:

Essential workers, social distancing, cave syndrome, drive-by rationing, super spreaders, rolling blackouts, quarantine, response team, generation pandemic, zoom conferences, food insecurity, humanitarian crisis, distance learning, pandemic brain fog, PPE supplies, PEP loans, masking up, front-line staff, preventable crisis, infra-structure, boil water notices, sanitizers, vaccine hesitancy, the New Normal, and normalizing trauma.

Coping with stress, grief, and worry led to innovative communication. People used isolation time to engage in virtual chatrooms, reconnect with old friends, and attend Zoom meetings. As COVID forced most businesses to become distanced, the Zoom era grew rapidly. Conferences, meetings, professional education, and customer service began utilizing cubes of people to contribute to the business. In the post-COVID recession, many businesses went under. Many frail companies were not on firm foundations and abdicated their abilities to improve and serve customer bases.

As a Big Picture business strategist, I encourage businesses to adopt new ways of thinking about old processes. Here are new acronyms for COVID to help you visualize opportunities differently:

COVID: Collective Ongoing Virus Incidents Decreased

COVID: Community Operations Verify Intelligence Data

continued on page 35

FEATURE

EDITORIAL

Changing Your Mindset for Networking Success

BY GAIL STOLZENBURG

What is a Mindset?

A mindset is an established set of attitudes held by someone. It is the collection of things you consciously or unconsciously believe or assume that influences how you meet your needs, how you feel, and how you think and approach things that ultimately influences your actions and outcome.

Carol Dweck, a Stanford psychologist and the author of Mindset: The New Psychology of Success, says there are two types of mindset: Fixed and Growth. “A fixed mindset assumes that our character, intelligence, and creative ability are static givens which we can’t change. A growth mindset, on the other hand, thrives on challenge and sees failure not as evidence of unintelligence but as a heartening springboard for growth and for stretching our existing abilities.”

What are the Qualities of Someone with a Healthy Growth Mindset?

• They keep the focus on the client and eliminate the “me”, “my”, “mine”, “we”, “us”, and “ours”.

• They ask probing questions about the needs of the potential client. When they find out what their symptoms are, they provide the remedies for them.

• They recognize that it is not possible for everyone to be their client. You can’t fit a size 12 foot into a size 8 shoe.

• If they can’t help them, they try to refer them to someone else who can.

• They try to include a story about someone else they knew who had a similar problem that their prospect can relate to.

• They never waste other’s time. They provide valuable and quality information.

• They never try to convince someone to eat shrimp if they are allergic to seafood.

• They never stop learning. They always take notes on the new things they learn.

• They regularly read nonfiction books and take self-improvement courses.

• They focus on networking every day whether it is in-person or online.

Why is Having a Growth Mindset so Important to Networking Success?

By listening intently to the questions people ask when you are networking with them, you are able to determine if they are the ones who have a Fixed Mindset or a Growth Mindset. If they say things like “Why is this always happening to me?” or, “Why am I unable to get ahead?”, they have a Fixed Mindset and you should spend less time with them. On the other hand, if they say, “How can I improve on that” or, “Where can I find out about that?”, they have a Growth Mindset and you have a greater potential in developing a business relationship with them.

It is so important to focus on your Target Market while networking. Determine who would be your best prospect and find out what is keeping them awake at night. Know at least three characteristics about them and focus on those during your introduction. We know the majority of people make the decision on whether to continue the conversation with you within a couple of seconds.

They need to convince themselves why you are the best person to spend their money with. If you are networking online, they need to see that you are confident and an expert in your field. And, always have a call-to-action resource such as offering a free report, a book, an article, etc. These are all aspects of developing your mindset. If you are unsure of yourself, how can you expect your prospect to feel confident with you?

Eventially, it is your mindset that will determine how you respond and the success you will have. The more you develop your mindset, the better life you will have with more opportunities and better relationships.

Change Your Mindset, Change Your Future

We can change our mindset in one second and there is no cost. It’s free to do. Instead of letting our mindset control us, by taking a chance we can change our future. Most people

are surprised to know that nature gives us a negative mindset.

We are internally preprogramed to fear everything as a means of self-defense. Nature wants us to protect ourselves so we can survive. Surviving is good but achieving is greater! Achieving requires us to stick our neck out. It requires us to take a risk of talking to strangers with the potential of being rejected. And what about others? Can they affect our mindset? Certainly! If we let them!

Ways to Change Your Mindset and Become a Better Networker:

• Make a commitment to remain positive, learn a new skill, and create a Healthy Mindset.

• Find things that make you happy such as nature walks, exercise, dark chocolate, swimming; then schedule time each week to do it.

• Take immediate action by doing a follow-up, making a phone call, making a commitment.

• When you were a baby and learning to walk, did you give up the first time you fell down? It is no different as an adult. You need to take one tiny action step. Hearing the word “no” shouldn’t stop you from trying again with a different person or in a different way.

• If you never make a change, what do you think is going to be the end result? The definition of insanity is to keep doing the same things over and over but expecting different results!

• Read books on mindset such as Think and Grow Rich by Napoleon Hill and Secrets to Mastering Your Mindset by Tom “Big Al” Schreiter.

Have you ever been told you need to change your mindset? Why is that important to your networking success?

EDITORIAL FEATURE

Gail

Visit

- So, change your mindset and see more networking success! -

Gail “The Connector” Stolzenburg is the Author of "21 Ways to Connect"

can be contacted by email at Gail@GailStolzenburg.com or by phone at (281) 493-1955

his website at GailStolzenburg.com

Protecting Your Company from Business Email Compromise (BEC) Attacks

BY CHRISTOPHER BUDD

Business Email Compromise (BEC) is a fast-growing cybersecurity threat that all businesses, especially small and medium-sized (SMB) ones, face. The FBI’s Internet Crime Complaint Center (IC3) reported in their 2020 Internet Crime Report that they fielded 19,369 Business Email Compromise (BEC) complaints amounting to over $1.8 billion in adjusted losses in the United States for that year.

BEC attacks primarily use email, but can be carried out using SMS messages, voice mail messages, and even phone calls. BEC attacks are notable because they rely heavily on so-called “social engineering” techniques, meaning they use trickery and deception against people.

Because BEC attacks apply social engineering, traditional security software doesn’t always protect against them. That means you and your employees must understand what BEC attacks are and how they work.

How BEC Attacks Work

While there are many ways BEC attacks can unfold, they all boil down to a simple formula. An attacker tries to convince an employee to send money to the attackers by impersonating someone that the employee trusts.

Attackers often try to stack the odds in two ways. First, they try to make their attack believable by who they choose to impersonate. Second, they try to create a sense of urgency so that the intended victim is less likely to follow the proper transaction procedures that could catch the scam.

For example, one type of BEC attack involves an employee getting an urgent message from the CEO or other high-level executive requesting the employee to pay a past due invoice or get gift cards for a company event. These can be email or text messages, but one executive in 2019 lost €220,000 (approx. $243,000) to attackers who even used deep fake technology to impersonate his CEO.

In another type of BEC attack, the attackers use fake and compromised accounts to exchange several emails with the intended victim that convince her or him that they’re a legitimate vendor, and then send them a fake invoice.

A third type of BEC attack targets company payroll. In these, attackers impersonate employees to convince payroll staff to change employees’ direct deposit information to the attackers’ bank accounts. These attacks are more subtle and take more time but can be very effective.

In almost all cases, BEC attackers’ goal is to get money through electronic funds transfers (including cryptocurrency) or gift cards. While using gift cards for an attack like this might be surprising, attackers have found it’s an easy way to transfer and launder money.

How You Can Protect Against BEC Attacks

BEC attacks really are old-fashioned fraud attacks that happen to utilize current technology. Because these aren’t technology-based attacks, technologybased solutions won’t be as effective against them. A well-made BEC email, for example, is hard for security software to distinguish from a legitimate one, especially if it’s coming from the actual — but compromised — account of someone you trust.

This means that protecting against BEC attacks needs to focus on two things: you and your employees.

First, educate yourself and your employees about BEC attacks. You and your employees should learn to be suspicious when a sudden unexpected email comes from the CEO saying, “I need you to get $5,000 in gift cards for a birthday party today, send me the numbers, and don’t tell anyone about it.”

Second, reinforce the importance of following the established rules for paying bills, changing direct deposit information, and sending gift cards. For example, employees should call the number on file for an employee or vendor requesting payment to verify that the request is legitimate. Emphasize that even if requests seem to come from high-level people in your company, employees still need to verify.

Ultimately, BEC attacks succeed because attackers fool their victims into believing their deception. Because BEC attacks use technology, thwarting them requires adjusting to the new ways these old-fashioned frauds operate.

The good news is that with proper training, education, and following procedures, you can thwart these attacks. You just need to educate yourself and your employees that these scams exist, how they operate, and the proper way to handle payment requests.

EDITORIAL FEATURE

Christopher Budd is the Senior Global Communications Threat Manager for Avast. For more information, visit the Avast website at avast.com/en-us/index or email Chris at christopher.budd@avast.com

What Small Business Owners Need to Know When

Hiring and Firing Employees

BY JILLIAN KERWIN

As the boss of your own business, you probably already know how important it is to maintain a strong team of employees. Employment has been a big topic over the past year due to COVID-19 layoffs, and as a small business owner, you need to know that hiring and firing people without taking the proper legal precautions can put your business in a serious legal blunder.

When it comes time to hire or fire an employee, you’ll thank yourself for knowing what steps you need to take to set your business up for success.

What to Keep in Mind When Hiring Employees:

Bringing someone into your business is an act of trust on both ends – you want to make sure you hire the right person, and they want to know they’re signing up for the right job.

To ensure a smooth transition and solid foundation from the get-go, make sure you follow these guidelines:

• Get your legal paperwork ready from the start

The requirements for hiring someone vary from state to state, so do some research on exactly what forms you need. Regardless of state, these two things are definitive requirements by the IRS:

- Set up an EIN (Employee Identification Number). This is a legal requirement for anyone you hire.

- Have them fill out the right tax documents. Think: W-4 and I-9, Employment Eligibility Verification.

• Interview intentionally

Prior to the interview, make a checklist of skills you need the new hire to have for

day-to-day esponsibilities, and use the conversation to confirm if the candidate has what’s needed to cross off the list. Additionally, get to know the candidate and consider how they would get along with your team.

• Make sure you follow post-hiring legal

requirements

Once you’ve made the decision, first thing’s first: It’s time to get this new employee legally started.

- Set up a payroll: You will need a payroll system that can withhold a portion of your employee’s income for the IRS.

- Create an employee handbook: While having an employee handbook isn’t technically a legal requirement, creating one can help prevent legal issues down the road. Having a thorough book that lists the “Do’s and Don’ts” of the job for your new hire to go through before starting can ensure expectations are understood. A handbook also provides you with tangible proof that you communicated expectations.

What to Know When Firing Employees:

Whether you have to let someone go because of the pandemic or because of performance, remember that communication is key. Always know your rights and ensure you’re going about it the legal way. Follow these guidelines for a roadmap:

• Write out the bullet points of “Why”

List out the reasons they’re being terminated. Be sure to call extra attention for issues that specifically go against the rules established in your employee handbook. Example: “Being late every day.”

•

•

Keep a paper trail of the reasons “Why”

You’ll want to document everything so you can prove that it’s true. Your paper trail could be timestamps that show the employee got to work consistently late. And it’s a bonus, if you followed our advice on having an employee handbook, you can show that your company rules clearly state that employees must be on time for their shifts.

Communicate legal requirements

Make sure you cover what the plan is for the remainder of their time, as well as what will happen with their benefits and last paycheck.

• Be honest but brief

Why? Especially if you’re firing someone due to performance, you want to keep it as professional and focus the conversation solely on reasons you think they are a wrong fit for the job. You should steer emotions out of the conversation and avoid saying anything unnecessary, because the conversation could be brought up if this were to become a legal issue for any reason.

When it comes to hiring and firing people, it can be tempting to cut corners and get it done as soon as possible. We get it - you’re busy running a business, and not to mention, it can be uncomfortable. But ensuring the process goes as smoothly as possible will protect your business and set up your employees for success.

Jillian Kerwin Content Writer

LegalShield

jilliankerwin@legalshieldcorp.com

EDITORIAL FEATURE

Office: (580) 436-1234

5 Ways Employers Can Improve Employee Financial Literacy

BY RICHARD TATUM

Financial pressure is significantly impacting the lives of millions. In fact, a significant majority of Americans agree that finances are their number one cause of stress - more so than politics, work, or family. This takes a toll not only on employees but also businesses. Employers lose nearly one month of productive workdays each year due to financially stressed employees. Given that April is Financial Literacy Month, it’s an opportune time to focus on improving employees’ access to tools and information, thus setting them up for a more secure financial future.

These Are Five Steps to Improve Your Employees’ Financial Literacy:

1. Offer a company-sponsored retirement plan. While retirement plans offer benefits to employers such as tax incentives and recruitment strategies, there are significant perks to employees as well. For employees, participation can reduce their current taxable income as well as improve their financial security in retirement. In fact, people with access to a plan are twice as likely to report planning for retirement than those who do not have access. To increase participation, you may also consider implementing specific plan features, including:

• Auto-enrollment: Setting up automatic enrollment has been proven to boost plan participation rates by as much as 221%. It could also have a positive impact on the amount employees save. Compared to employees in plans where enrollment is voluntary, saving rates are 56% higher for individuals in plans with auto enrollment.

• 401(k) match: For employees, this is essentially free money, encouraging them to save faster and more successfully for their future. For you, it means a bigger tax break.

2. Provide financial literacy training. Two-thirds of Americans fail a financial literacy test on topics such as interest rates, debt, and investing. While financial education programs are on the rise (they’re required in school curriculums in 37 states), we still have a long way to go. Employers have an pportunity to educate their employees in the

office (or virtually). To help close the knowledge gap, consider inviting a local financial advisor to come speak with employees on a quarterly or bi-annual basis.

3. Show you’re investing in them. Whether you’re providing a 401(k) match, college loan reimbursements, HSA incentives, or financial literacy programs, literally “investing” in your employees shows your commitment to fostering financial wellness in the workplace. In turn, it can motivate employees to learn more about their personal finances and help them meet their financial goals.

4. Make it fun. Research confirms that fun experiences promote learning, memory retention, and willingness to try new things. The gamification of financial education in the workplace can help you create informative yet entertaining content for your team. Consider implementing money saving challenges to make saving for the future exciting and competitive. You can also gamify financial literacy education through the use of mobile apps.

5. Provide a financial toolkit. Create a financial literacy toolbox for employees, which can include resources and free tools like retirement planning and investing estimators, budgeting calculators, and credit score simulators. You may also want to incorporate instructions for how to create a budget as well as a glossary of financial terms.

As the lines between work and life continue to blur, the day-to-day stresses can impact the performance of your employees more than ever. By providing ways to improve financial literacy, you can help reduce financial stress, improve employee well-being, and increase retention. Whether you choose to take up one - or all! - of the steps above, the investment in your employees’ financial wellness will leave a lasting impact for years to come.

FEATURE

EDITORIAL

615-480-3244

Richard Tatum President of Retirement Services

Vestwell

richard.tatum@vestwell.com

BY GREG PLUNKETT

In today’s COVID environment, many businesses are suffering. If your company extends credit to other businesses, it is more important than ever to use business credit reports when determining whether or not to extend credit. It’s the best way for you to make fast decisions without making bad decisions and it gives you the most reliable information available.

A business credit report highlights information contributing to a company’s risk potential, identifies strengths and vulnerabilities, and offers in-depth details on its financial activities.

What follows are the key components of a business credit report and how they can help you make better, more profitable decisions:

1. Identifying information – This data includes important information such as the primary business name, address, inquiry match details, unique business ID, and Ultimate Parent name for businesses that are part of a corporate hierarchy. Phone number, URL, and Tax ID Number are also provided when available. With this information, you can determine how long the company has been in business and verify the company’s business location.

2. Risk dashboard – The elements included here highlight datapoints that are related to risk including payment history, public record activity, and even possible fraudulent activity.

• You can see how a company pays its bills as compared to other businesses in its industry.

• The payment history shows you how the company has paid invoices within the past 6 to 12 months – very valuable information when determining how much credit to extend.

• Public records will showcase any

bankruptcies, tax liens, or judgment filings against the company which are clues to a company experiencing financial distress.

• The business category enables you to identify whether the data contributor is a primary or secondary supplier and compare the business’ payment habits across the industry.

this information, you can be confident in the legitimacy of the company and how it operates.

4. Credit risk score – This score predicts the likelihood of the company going seriously delinquent or bankrupt within the next year. With highly predictive risk scores you are better positioned to make a fast and accurate assessment of risk.

5. Financial stability score – Obtains a clear understanding of a company’s likelihood of financial stability risk within the next 12 months. It even determines the percentage of businesses that are riskier and more likely to have financial issues compared with your customer.

• Terms set by other vendors can also be seen. This allows you to see if the business pays others on time and is a way to determine what credit terms to set.

3. Fraud checks – A business credit report also screens for potential indicators of recent fraud. It checks against potential listings on the OFAC warning list, whether the business has been a previous victim of fraud, or if there are any inconsistencies with the company name, phone number, address, or Tax ID number. Armed with

Just imagine having all the information you need to confidently reduce risk and identify emerging growth opportunities –right at your fingertips. With a business credit report, it can happen. It offers companies that extends credit an exceptional level of customer information that enables you to conduct business with greater confidence. These reports offer a snapshot overview as well as detailed data that relates to business payment performance, public record history, and company backgrounds. They allow you to determine the creditworthiness of a business and make sound decisions that will improve your ROI and mitigate risk easily and accurately.

How to Get the Most Value out

Business Credit Report

of a

IT OFFERS COMPANIES THAT EXTENDS CREDIT AN EXCEPTIONAL LEVEL OF CUSTOMER INFORMATION THAT ENABLES YOU TO CONDUCT BUSINESS WITH GREATER CONFIDENCE. EDITORIAL FEATURE

Author: Greg Plunkett, Director, Business Information Services at Credit Plus, Inc., a leading provider of business data. He can be reached at gplunkett@creditplus.com.

Lenovo

Listening to SMBs, Taking their Pulse, then Providing Successful Remedies for Business Health and Future Wellness

By Mary J. West

The current health and future wellness of a business can stem from a myriad of factors. Now more than ever, businesses are dealing with challenges they have never before encountered. For them to survive and flourish, they need to consult with specialists who can empathize with their problems, really listen, and provide successful remedies. One company in particular, Lenovo, has made such a critical difference in taking the pulse of small to medium businesses (SMBs) and providing successful remedies that it has quickly risen to become the world’s largest PC company and one of the largest IT companies.

Lenovo offer all kinds of technology solutions, from smartphones and personal computers to services and complex data center solutions for businesses of all sizes; but what sets them apart is that they are focused on listening to their clients and providing them the devices, solutions, and services that help, serve, and solve their technology needs. According to Emily Ketchen, Vice President and Chief Marketing Officer of the PC and Smart Devices Division. “Being great listeners involves several methods of collecting feedback from customers which has given us insights in how to best meet their needs.”

These insights have enabled Lenovo to devise innovations that have made it a visionary leader in electronics on the world stage. Launched in China in 1984 by a group of technologists who got their start as a small business specializing in

televisions, they took the opportunity to push technology forward. Later, in 2005, they acquired the personal computer division of IBM, and that is where a number of the PC pieces came together such as the ThinkPad and ThinkBooks for SMBs. In addition, Lenovo developed consumerbased and gaming products such as Yoga and Legion. No wonder that Lenovo has become the largest, worldwide vendor of personal computers!

Lenovo, whose mission statement is “To provide smarter technology for all”, can truly relate to business owners because they too have an incredibly entrepreneurial spirit which drives both individual contributions and meaningful results. Notes Ketchen, “Lenovo has a unique entrepreneurial spirit that has led to the production of an enviable breadth of technology portfolio. It sells products in 180 countries, which includes desktop, laptop, and tablet computers, as well as smartphones, storage devices, and peripherals. The company also carries servers, supercomputers, and complex data systems solutions.”

Despite such a broad array of electronics, Lenovo’s primary goal is not to sell but to listen intently, take the pulse of the client, and serve as advisors to the businesses that are their customers. Just what is this “listening” that has propelled the company to its leadership role? It takes several forms, all of which allow it to understand, support, and provide remedies for its customers. One form is a robust insight community where Lenovo engages with more than 4,500

customers who own small and medium businesses. The community continually asks customers how things are going from a technological perspective. In addition, Lenovo has advisory councils, which are constantly hearing from customers and helping them solve their challenges.

Other listening comes in the form of research that involves focus groups and observational studies. The company also has a customer insights dashboard, a listening tool that has captured more than 20 million unsolicited comments from those who buy their products. Lenovo has harnessed information gained through these means of customer engagement to improve product features. Such innovations deliver tangible advantages, often addressing the needs of customers before they’re fully aware of them.

Because the business climate is everchanging, it’s essential to keep a close pulse on it to keep up with the times. “One example involves this world of 24/7 collaboration where some of us are working from home,” Ketchen relates. “We thought, ‘Wouldn’t it be great to have a laptop that includes built-in earbuds that are charged, automatically configured, and optimized to make it easy to hop on a call or participate in a meeting?’ So we included that in our ThinkBook 15-inch laptop, a brand we specifically created for SMBs. It’s a great innovation that came about as a result of listening to customers.”

PROFILE

continued on page 35

How SMBs Can Promote Digital Wellness Through Collaborative, Accessible, and Secure Technology

BY EMILY KETCHEN

In a fast-paced, tech-driven world, it’s not unusual to be surrounded by multiple devices and screens creating a sensory overload. We rarely stop to consider how it might be affecting our well-being. While some companies have instituted programs to promote wellness, whether it’s offering free fitness classes or access to therapy services, few contemplate how technology can actually promote digital wellness. The average share of adults reporting symptoms of anxiety and/or depression has increased from 11 percent in 2019 to 31.5 percent by March of 2022. Thankfully, more than three quarters say good technology has a positive impact on a work/life balance.

The work-from-anywhere culture is prompting more companies to assess technology that is tailored to the evolved needs and behaviors of the workforce. As wellness in the workplace is progressively discussed and researched among organizations, devices that are collaborative, accessible, and secure can contribute to improved well-being and will further advance tech enablement for Small and Medium Businesses (SMBs).

Collaborative Technology Promotes Digital Wellness